Hands Across The Water

Profound political transformation has been underway in South Africa since 1990 when the dismantling of the entrenched apartheid system began, and Nelson Mandela was released from prison after 27 years. The democratic growth of this nation has continued with the election of President Mandela and the instalment of the South African Government of National Unity.

This pivotal change in South Africa has clear and positive implications for the financial future and stability of the country. The shift towards democratic government led to the lifting of US economic sanctions which, in tum, fostered a new atmosphere in which both the United States and South Africa could build stronger economic and commercial bonds. The people of South Africa have undertaken a magnificent and far reaching challenge. They are building a new political, economic and social foundation of non-racial democracy. They are working to construct an economic system to ensure economic independence and free enterprise access to all South Africans. The South African Government of National Unity at all levels has sent a consistent message to business audiences around the world: South Africa wants needs and welcomes foreign private investment. It is estimated that the economy has the potential to expand at the rate of 5 per cent annually. The country is finally emerging from a lengthy recession, registering positive growth in 1993 for the first time in four years. But the long legacy of apartheid continues to have severe repercussions. South Africa suffers from a 45 per cent unemployment rate, as well as the need for massive electrification, education, housing, sanitation and health care access. The US and South Africa are committed to working together to confront the enormous economic challenges posed by these conditions. Since the removal of US sanctions, nearly 60 US firms have returned to South Africa. Their decision is the best testimony that the South African government is creating the necessary enabling environment for foreign investment over the long term. The fiscally conservative, non-inflationary budget introduced this summer is the best indication thus far that the South African government is serious in its economic commitments. Specific steps are being taken by the United States to promote trade and investment in South Africa. Under President Bill Clinton’s leadership, various actions have been taken to promote bilateral trade and investment relations with South Africa including the US commitment to immerse our private sector in the construction of a new South Africa after the lifting of sanctions and the President’s emphasis on assisting the emerging black private sector in South Africa. The enactment of the South African Transition to Democracy Support Act; my trade and investment mission in November 1993; and the heightened US financial profile in South Africa are proof of this unwavering pledge of support. The delegation of US government and high-level private sector leaders that I led on the trade and investment mission was requested by President Clinton to explore business opportunities, particularly with South Africa’s black private sector, and to work towards creating an environment in South Africa conducive to foreign investment. This mission paved the way for the signing of a bilateral operating agreement with the South African government on behalf of the Overseas Private Investment Corporation (OPIC), to permit the application of OPIC programs there. The United States Department of Commerce is especially committed to South Africa’s economic reconstruction. We have launched a five-pronged initiative to promote trade and investment in South Africa:

- I personally have appointed Millard Arnold as the US and Foreign Commercial Service Minister Counsellor for Commercial Affairs in South Africa, our highest ranking

Foreign Commercial Service Officer;

- I have designated South Africa as one of the world’s 10 Big Emerging Markets – a distinction that means added importance to the country’s bilateral trade picture with the United States and a concentration on trade advocacy and focus;

- A United States-South Africa Business Development Committee has been created to expand bilateral commercial dialogue and partnerships;

- A major market research program has been initiated in South Africa to assist US firms in introducing their products;

- A major trade promotion program has been designed to last at least through the next two years.

This is the first time in 30 years that an aggressive US trade promotion program has been planned around South Africa. In addition to teleconferences and trade missions in regard to housing, health care, telecommunications, electrification and investment and financial services sectors, a department of Commerce certified trade exhibit, the “Made in USA Trade Expo,” will showcase a broad range of American products and services in Johannesburg. Specific steps also are being taken to encourage joint ventures between US business people and disadvantaged business people in South Africa. The Department of Commerce initiative has two parts:

- I personally have appointed Millard Arnold as the US and Foreign Commercial Service Minister Counsellor for Commercial Affairs in South Africa, our highest ranking Foreign Commercial Service Officer;

- I have designated South Africa as one of the world’s 10 Big Emerging Markets – a distinction that means added importance to the country’s bilateral trade picture with the United States and a concentration on trade advocacy and focus;

- A United States-South Africa Business Development Committee has been created to expand bilateral commercial dialogue and partnerships;

- A major market research program has been initiated in South Africa to assist US firms in introducing their products;

- A major trade promotion program have been designed to last at least through the next two years;

- A partnership with OPIC to introduce US investors to appropriate majority South African business persons; and

- A planned “Minority Matchmaker” trade mission to South Africa to meet with South African counterparts.

The Department of Commerce is not the only US entity that is involved in the promotion of private enterprise development in this area. The US Agency for International Development has pledged over $400 million to develop an overall strategy that targets key housing and electrification needs and growth of the black private sector through several initiatives. These efforts are designed to improve the availability of affordable housing; expand electrification in disadvantaged areas; and provide working capital and equity capital through credit guaranty mechanisms and an Enterprise Fund, as well as provide technical assistance.

With the lifting of trade sanctions by other African countries, South Africa, where exports and imports account for more than 50 per cent of the country’s gross domestic product, is being viewed by both foreign and domestic companies as the springboard to southern African regional markets. International financial institutions are very optimistic about mounting major development programs within South Africa and providing much of the capital needed for social programs. At least three American financial groups have raised private capital funds for investment in South Africa. Although the South African economy is moderate by international standards, it is the largest and most widely developed on the African continent. It has a modern infrastructure and its financial, legal, communications, energy and transport sectors are well-developed. The economy, based on manufacturing, mining, agriculture and services, boasts a global trade surplus of almost $1 billion. The Johannesburg Stock Exchange ranks among the top ten in the world. The United States recognizes that South Africa, as the economic superpower of the African continent, has the potential to overhaul its economic system, open its import market, expand its export market and become more internationally competitive. A clear commitment to stimulate the return of American firms to the South African market has been expressed by government officials and political parties in South Africa. The focus of these and other groups has been to generate a shared vision of the path for economic growth and to confront the socio-economic disparities created by apartheid. On my visits to South Africa, both on my official trade and investment mission and as part of the official United States delegation to the inauguration of President Mandela, I found most South Africans positive and optimistic about the future. The steps being taken to repair the economic state of the country – the breakdown of the apartheid system, the lifting of sanctions, the emergence of South African products in world markets – all are signs that a new era is dawning. As the South African market continues to grow, the possibilities of fortified commercial ties with the United States also continue to expand. The Clinton Administration strongly supports this new relationship.

South Africa, The Journal of Trade, Industry and Investment

Publisher, David Altman

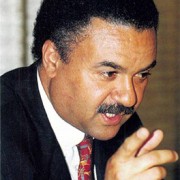

Writer, Ron Brown